Sandstorm Gold Arrives In Mongolia

Sandstorm Gold (SAND) is a precious metal streaming company. They provide financing for gold mining companies in exchange for a long-term gold stream. As stipulated on their website 'A gold stream involves Sandstorm making an upfront payment to a mining partner that is in need of capital to build their mine, refinance their obligations, complete an acquisition or for various other reasons. In exchange for that upfront payment, Sandstorm receives a contract which stipulates the purchase of a certain percentage of the gold produced from the mine, for the life of the mine, at a fixed per unit cost.' The fixed cost per ounce of gold is typically heavily discounted in comparison with the prevailing spot price. We provided more information on Sandstorm Gold in a recent article.

On February 15 Sandstorm Gold announced to the market that they have just closed another deal. We were instantly intrigued and decided to investigate the background, which we would like to summarize in the present article.

Rio Tinto's (RIO) world class Oyu Tolgoi Mine in Mongolia is at the heart of the story as we see it. This mine is currently under construction and production of first copper concentrate is imminent with commercial production scheduled to start before mid-year. The mine is estimated to yield 25 million economically viable tonnes of copper and is expected to last for more than 50 years. This mine will cost in excess of $10B to build and it will turn Mongolia into one of the world's leading copper producing countries.

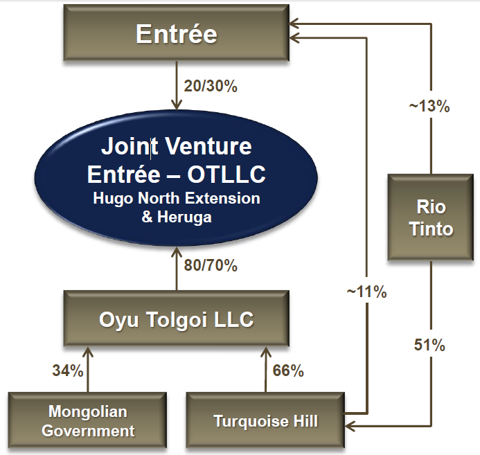

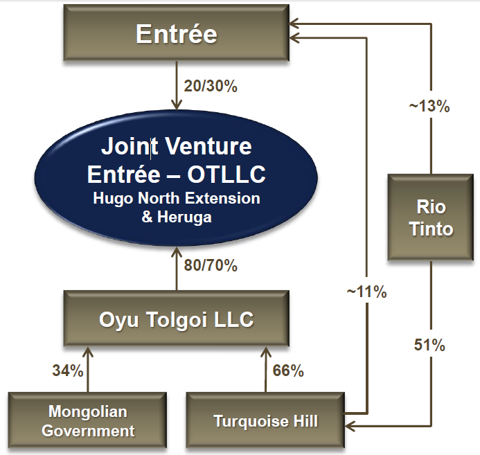

The exploration properties immediately to the south and also to the north of the mine are not controlled by Rio Tinto directly, but by a JV entity called 'Entree - Oyu Tolgoi LLC Joint Venture'. The corporate structure of this JV is shown below. Obviously Rio Tinto controls this JV, but more to the point of the present story, a company called Entrée Gold (EGI) holds a 20% interest as well. And it is Entrée Gold that Sandstorm Gold has entered into an agreement with.

(click to enlarge)

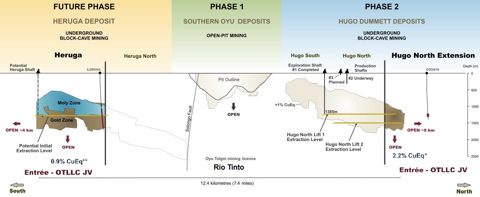

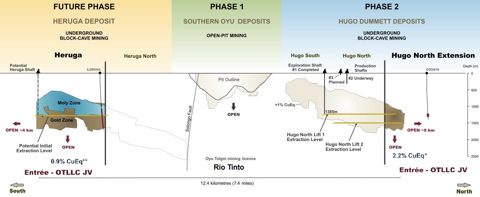

The importance and prospectivity of the land holding can hardly be underestimated, as visualized in the long section below. Phase 2 development of the Oyu Tolgoi mine will include the Hugo underground mine and the northern portion of this mine called Hugo North Extension will reach beyond Rio Tinto's direct control into the JV territory that Entrée Gold has a stake in. The southern portion of the land holding is called the Heruga deposit and also holds great future potential for a substantial underground operation.

(click to enlarge)

Sandstorm Gold is paying $35M for the rights to purchase 25.7% of Entrée Gold's share of the gold by-products of these deposits, and 33.8% of the silver. Sandstorm Gold will pay $220 for each ounce of gold, and $5 for each ounce of silver for an initial period switching to $500 for each ounce of gold and $10 for each ounce of silver thereafter.

A further $5M is being paid to Entrée Gold by Sandstorm Gold for the right to purchase 2.5% of the copper produced in the two deposits for an initial price of $0.50 per lb rising to $1.10 per lb. Sandstorm Gold has sold the copper component of the agreement to their sibling company Sandstorm Metals & Energy (TSX.V:SND) in exchange for shares worth $5M.

seekingalpha.com

On February 15 Sandstorm Gold announced to the market that they have just closed another deal. We were instantly intrigued and decided to investigate the background, which we would like to summarize in the present article.

Rio Tinto's (RIO) world class Oyu Tolgoi Mine in Mongolia is at the heart of the story as we see it. This mine is currently under construction and production of first copper concentrate is imminent with commercial production scheduled to start before mid-year. The mine is estimated to yield 25 million economically viable tonnes of copper and is expected to last for more than 50 years. This mine will cost in excess of $10B to build and it will turn Mongolia into one of the world's leading copper producing countries.

The exploration properties immediately to the south and also to the north of the mine are not controlled by Rio Tinto directly, but by a JV entity called 'Entree - Oyu Tolgoi LLC Joint Venture'. The corporate structure of this JV is shown below. Obviously Rio Tinto controls this JV, but more to the point of the present story, a company called Entrée Gold (EGI) holds a 20% interest as well. And it is Entrée Gold that Sandstorm Gold has entered into an agreement with.

(click to enlarge)

The importance and prospectivity of the land holding can hardly be underestimated, as visualized in the long section below. Phase 2 development of the Oyu Tolgoi mine will include the Hugo underground mine and the northern portion of this mine called Hugo North Extension will reach beyond Rio Tinto's direct control into the JV territory that Entrée Gold has a stake in. The southern portion of the land holding is called the Heruga deposit and also holds great future potential for a substantial underground operation.

(click to enlarge)

Sandstorm Gold is paying $35M for the rights to purchase 25.7% of Entrée Gold's share of the gold by-products of these deposits, and 33.8% of the silver. Sandstorm Gold will pay $220 for each ounce of gold, and $5 for each ounce of silver for an initial period switching to $500 for each ounce of gold and $10 for each ounce of silver thereafter.

A further $5M is being paid to Entrée Gold by Sandstorm Gold for the right to purchase 2.5% of the copper produced in the two deposits for an initial price of $0.50 per lb rising to $1.10 per lb. Sandstorm Gold has sold the copper component of the agreement to their sibling company Sandstorm Metals & Energy (TSX.V:SND) in exchange for shares worth $5M.

seekingalpha.com

Itinerant

Comments

Post a Comment